Conclusion

It is evident that businesses worldwide are entering a critical phase of transition, where climate action is not just a moral imperative but a powerful economic driver. The urgency to decarbonize is growing rapidly, and this transformation is reshaping industries, including the machinery and equipment (M&E) sector. To succeed in this endeavor, M&E companies must confront the challenge of managing emissions that originate beyond their direct suppliers, which poses unique difficulties. Climate strategy, and procurement/supplier management become more and more intertwined.

China's central role in global M&E supply chains cannot be overstated. It not only serves as a major producer but also as a significant source of supply chain emissions for countries like Germany and the United States. The potential impact of Chinese regulations on international trade, and carbon pricing, should not be underestimated, especially in the context of evolving global climate policies.

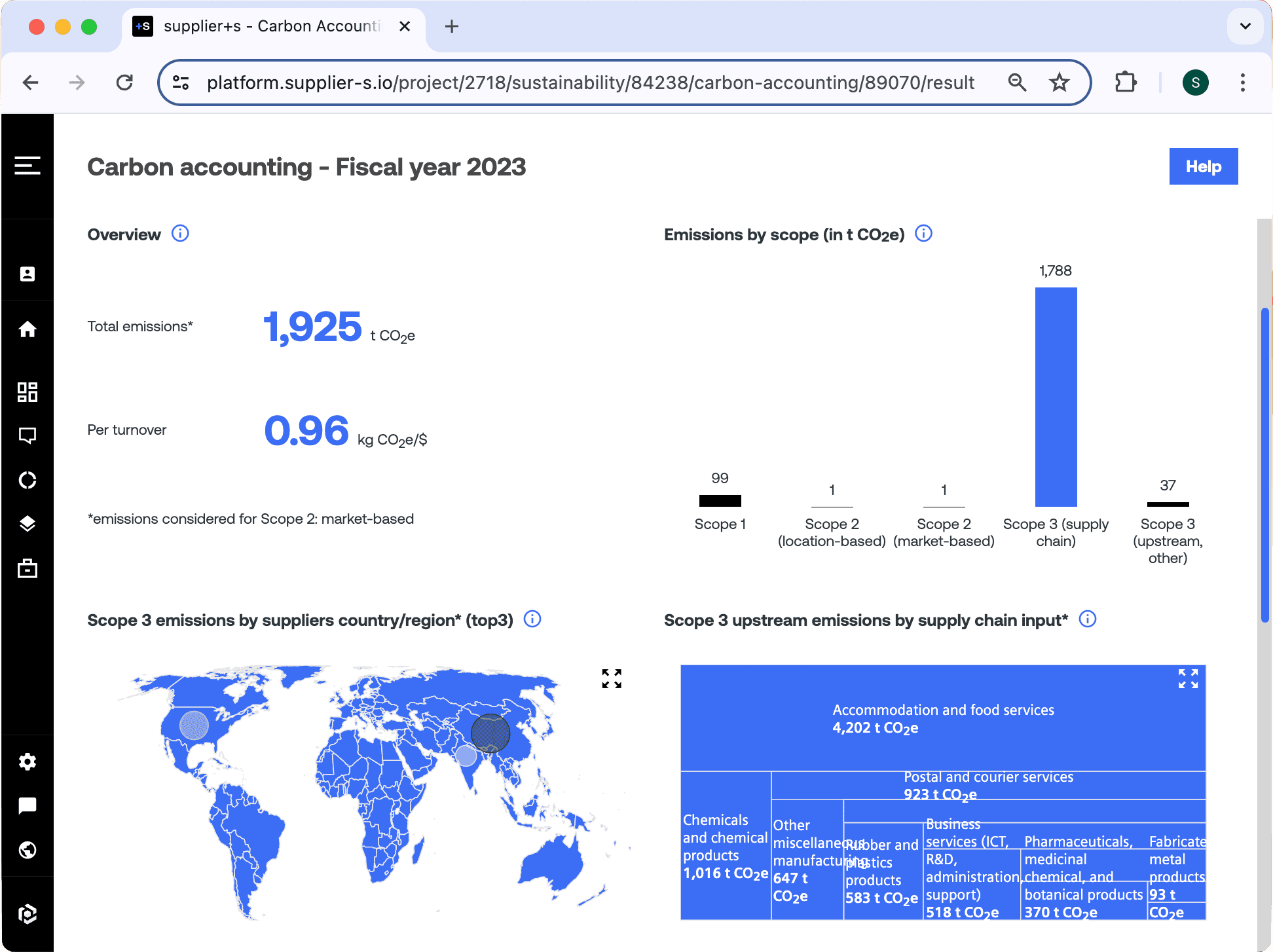

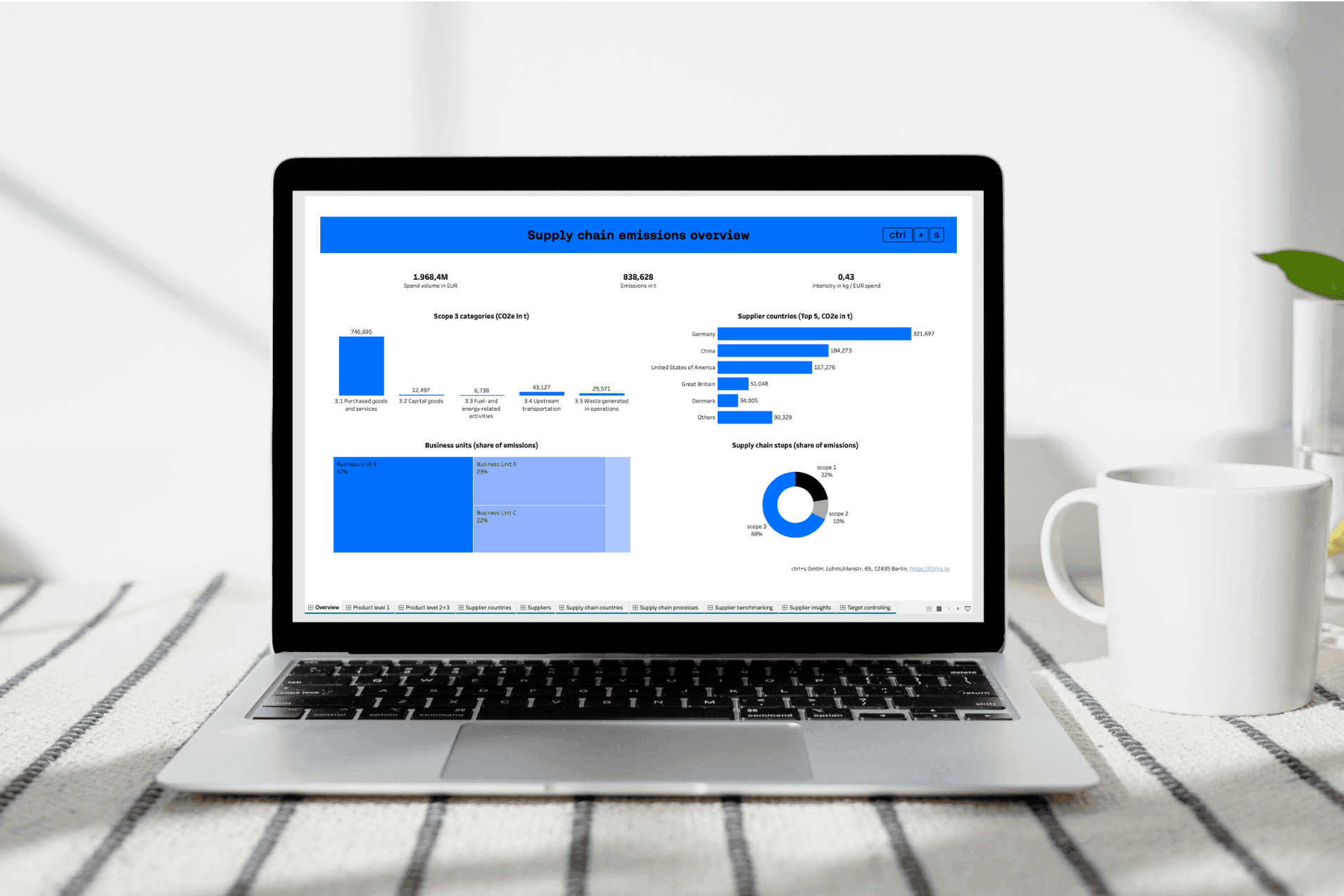

Both, risk management and climate change mitigation, need reliable and actionable data. And as difficult as it is to unravel complex global supply chains, there is a solution to it! All the insights into the M&E industry within this post come from our carbon model matter+s. With this model and the accompanying tool-set, ctrl+s provides a shortcut to supply chain carbon management.

In the upcoming posts of the “talking number+s” series, we will investigate the situation of other key industries and countries on the path to decarbonization of our global economy.

Johannes Scholz, co-founder ctrl+s

7th September 2023